As we approach the end of another year, we want to take a moment to express our heartfelt gratitude for your trust and support throughout 2024. It’s been a pleasure working with you, helping navigate the financial challenges and celebrating the successes along the way.

Christmas is a time for reflection and gratitude, and we are truly thankful for the opportunity to assist you in managing your finances, ensuring compliance, and helping your business grow. As we look forward to 2025, we're excited about the opportunities and challenges the new year will bring.

May this holiday season bring you joy, relaxation, and time to recharge with your loved ones. Here’s to a prosperous New Year filled with growth, success, and new opportunities!

Warmest wishes for a Merry Christmas and a Happy New Year.

Sam & Melisa

We provide seasonal payroll services. We’re here to help you manage the complexities of seasonal payroll with ease.

Our services ensure accurate and timely wage calculations for your seasonal workers, fully compliant with relevant awards and agreements. We also take care of superannuation contributions, ensuring they’re made correctly and on time, even for casual or temporary staff.

Additionally, we handle Single Touch Payroll (STP) reporting, ensuring that all payroll data is submitted directly to the Australian Taxation Office (ATO) without hassle. With our flexible and efficient payroll solutions, you can focus on your business while we ensure full compliance and smooth operations during your busiest times.

Are you new to business or expecting to earn income from business and investments above the threshold? If so, consider voluntarily entering into PAYG instalments!

Why Choose PAYG Instalments?

Prepaying your tax through PAYG instalments offers several benefits:

Voluntary PAYG instalments are a proactive way to stay in control of your business finances.

On 1 July 2024, the superannuation guarantee (SG) rate increased from 11% to 11.5%.

We wanted to quickly remind you that our emails may occasionally end up in your spam or junk folder. If you’re not seeing invoices or letters, please take a moment to check your spam folder and mark our emails as "Not Spam" to ensure you don’t miss any important information from us. We appreciate your attention to this, and we're always here to assist if you need any help!

To register your interest, please submit a cover letter and resume to admin@mwata.com.au or apply via the link below.

Just a reminder that the RAA drought infrastructure loans are still available (and will be until the funding is exhausted).

The loan can be used to:

Max borrow amount: $1m

Interest rate: 2.5% fixed

Term: 20 years

If you need assistance to apply, please contact our office.

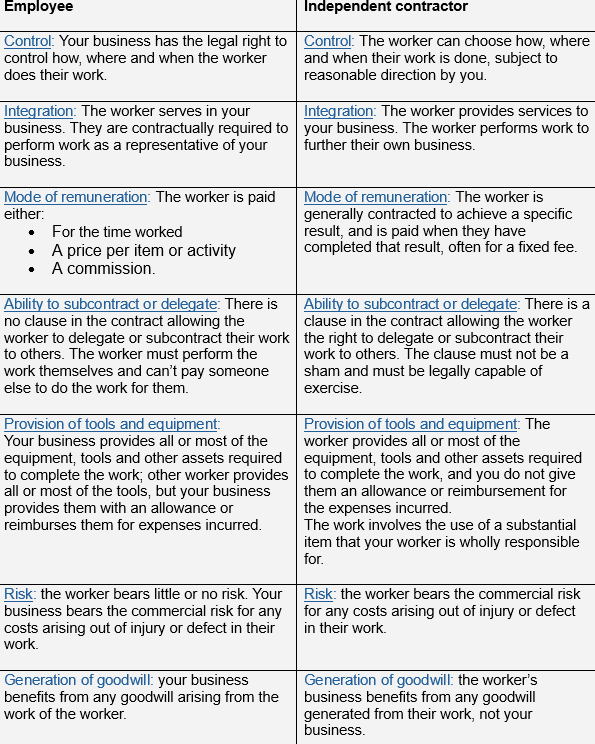

Most businesses that employ contractors understand there is a risk that a contractor may actually be deemed an employee by the ATO.

For example, a business has engaged a contractor for several years, they have paid the contractor their hourly rate but have never paid superannuation or other employee benefits. The ATO reviewed the arrangement and decided that, applying the “multifaced test” the contractor is actually an employee. The business will be liable to pay the contractor several years of superannuation and other employment benefit payments.

The employee v’s contractor relationship can also be challenged by fair work. If a contractor is injured at work, they may not have their own workers compensation insurance policy in place. They may be advised that they should challenge their employer and prove that they are, in fact, a deemed employee and should be covered by the employer’s workers compensation policy. This may create a significant liability for the employer.

The test to define the difference between a contractor and an employee were well established (until now).

A recent High Court judgment in CFMMEU v Personnel Contracting [2022] has confused the employee v contractor relationship again. In the case the court diverted from the above multifaceted tests. Instead, they examined the written contract between the employer and contractor. The contract clearly stated that the relationship was one of a contractor (although applying the multifaceted test suggested the relationship was one of an employee). The court found that the relationship was that of a contractor – because that’s what the contract said.

It is becoming more difficult for clients to manage their contractor risk. Our suggestion is to offer employment to any long-term contractors to minimise risk. It seems this issue is one of, "everything is right… until its not."

Australians love property and the lure of a 15% preferential tax rate on income during the accumulation phase, and potentially no tax during retirement, is a strong incentive for many SMSF trustees to dream of large returns from property development

https://www.ato.gov.au/newsrooms/smsf-newsroom/smsfs-investing-in-property

“…no matter what life throws at you, seek out opportunities to contribute, to participate and to action change….have a crack, and as I like to say, don’t just lean in, leap in.”

Joint Australian of the Year 2024 Richard Scolyer

Inside this newsletter

Inside this newsletter:

Inside this edition:

Inside this newsletter:

Inside this newsletter:

Inside this newsletter:

Inside this newsletter:

Inside this newsletter: